REUTERS/Susana Vera

“If you fail to prepare, you prepare to fail”

—Proverb

December is the last step in the dance for the sector-by-sector roll-out to solo regulated financial services firms of the United Kingdom’s (UK) Senior Managers and Certification Regime. The UK is by no means alone in seeking to make it easier for regulators to hold senior individuals accountable for their (in)actions.

Senior manager accountability regimes are proliferating worldwide. Where specific accountability regimes are not in place, regulators are using other means, such as cooperation credit, to drive better, risk-aware forms of behaviour by those in positions of power.

In a new special report, Thomson Reuters Regulatory Intelligence (TRRI) analyses these changes and assesses how best individuals can prepare for enhanced personal accountability. Hong Kong, the UK, and Australia have already introduced substantive accountability regimes while Singapore and Ireland are in the planning or consultation stages. In North America, the use of cooperation credit has changed the landscape for individual liability, and the enforcement of the United States Foreign Corrupt Practices Act continues to see senior individuals held liable. The report also touches on other areas where personal liability and accountability can arise at the most senior levels of a firm.

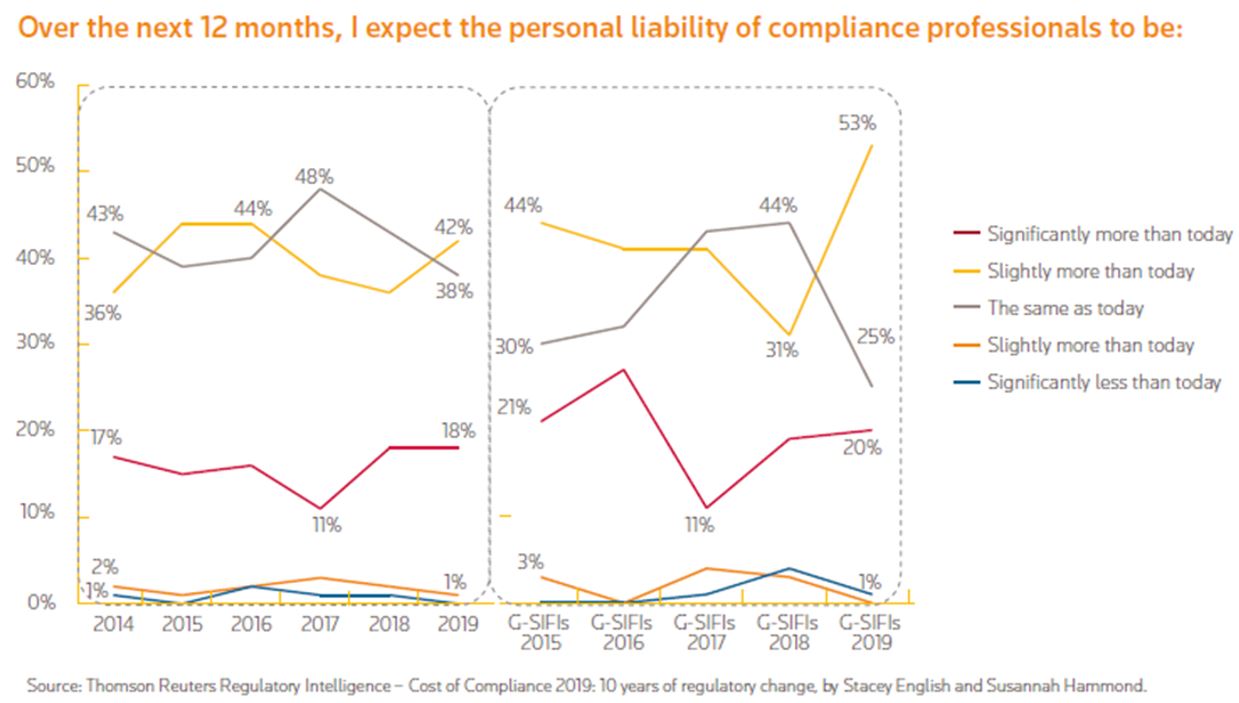

Compliance officers in financial services firms are already keenly aware of their potential personal liability. The TRRI annual Cost of Compliance report has reflected these growing accountability concerns; and the recent 10th annual report showed that the vast majority of firms (98 percent) expect the personal liability of compliance professionals to either remain the same or grow in the coming year.

Regulators are not simply seeking an easier way to punish senior individuals for regulatory breaches, but are, through specific coordinated policy actions, trying to ensure better risk-aware behaviours in the first instance.

For more on how personal accountability is playing out across Asia, view this new video in which Thomas Reuters’ Megha Chaddah discusses the subject with Helen Chan, a regulatory intelligence expert for TRRI in Hong Kong.

Senior individuals in financial services firms are on notice that the regulatory regimes are shifting to make it easier for supervisors to hold people to account for their actions and inactions. All the possible causes of misconduct, from incentives to culture, have come under policymakers’ spotlight. Regulators have also focused on the need to eradicate the potential for ‘rolling bad apples’, making it more difficult for individuals to keep changing firms or jurisdictions to stay ahead of supervisory attention.

TRRI’s special report gives senior individuals insight into how to better manage the challenges arising from personal regulatory risk—and it is not an insignificant potential risk.

Senior individuals found to have been in breach of their obligations will increasingly find themselves subject to regulatory enforcement action and will be unlikely to hold a senior position in financial services again.

Accountability gets personal: are you prepared for the rise in accountability regimes? Download the special report here.