Since the financial crisis, financial services firms have seen unprecedented levels of regulatory change as governments and policy makers have sought to ensure that a similar global downturn could not happen again.

While balance sheets have been rebuilt and the rule books have fundamentally changed, it remains to be seen whether the changes will successfully limit the potential for major global economic harm. For compliance officers, the last 10 years have also been a time of fundamental change. Not only have they had to cope with the challenges presented by the sheer volume and complexity of regulatory change, but in that time their remit has substantially morphed and changed as well.

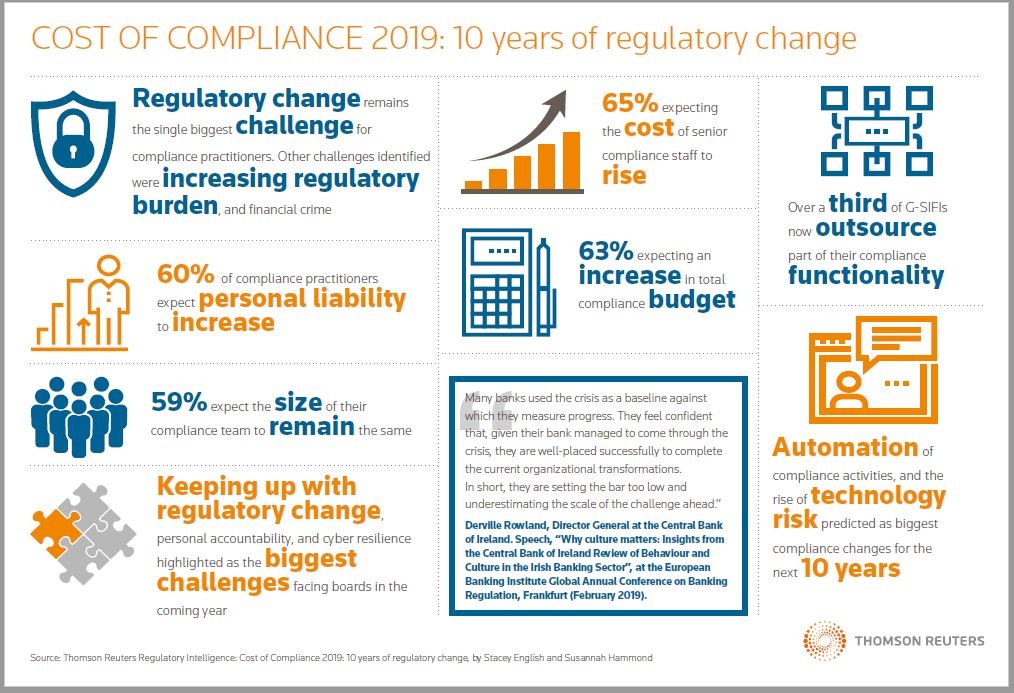

In this environment, Thomson Reuters Regulatory Intelligence (TRRI) conducted its 10th annual Cost of Compliance Survey in the fourth quarter of 2018.

Almost 900 responses were received from risk and compliance practitioners worldwide, including those in Asia Pacific, the Americas, the UK and Europe, the Middle East and Africa. Respondents represented firms across all sectors and sizes of the financial services industry including banking, insurance, broker-dealers and asset management.

Over the lifetime of TRRI’s ‘Cost of Compliance Report’, there have been almost 6,000 participants and more than 40,000 downloads of the report by financial services firms, Global Systemically Important Financial Institutions (G-SIFIs), regulators, law firms, domestic governments and consultancies.

The Technology Factor

In terms of compliance and evolving duties, it is perhaps with technology that the greatest change has been seen over the last 10 years in terms of remit, expectations and terminology. In 2019, fintech, regtech, insurtech, suptech and bigtech are all common currency alongside all things cyber. Risk and compliance functions have had to consider and deal with substantive issues before firms can begin to realize the potential benefits offered by technological innovation.

The successful deployment of technology and the ability to automate future compliance activities are seen as two of the greatest potential innovations for the next 10 years in compliance.

You can download the 2019 Cost of Compliance Report here.

While there will be numerous challenges to overcome, there are huge possible benefits to firms and their customers alike from solutions deployed successfully on a secure IT infrastructure by highly skilled in-house specialists. Much of the benefit is focused on process with the potential to automate with increased accuracy and speed. The endgame is smoother, efficient operations enabling risk and compliance functions that can focus on more ‘value-add’ matters.

A word about assessing the monetary cost of compliance. The 10 years of the cost of compliance survey has shown it is extremely difficult for firms to isolate out the monetary costs associated with compliance alone. One complication is the definition of what precisely is included in compliance—one firm’s compliance is another’s quality control or regulatory risk.

Another complication is the assumption that spending on compliance activities is something that firms would not do unless they are required to do so. The line between what a firm would spend to remain in business, treat its customers well and act prudently—and what it spends simply to be compliant with regulations is often blurred and often non-existent.

Estimates for spending on compliance make great headlines, but they should be treated with a degree of caution. Non-compliant firms will find the enforcement action (both corporate and personal) substantially more expensive, in all senses, compared to investing in compliant activities in the first instance.

Download your copy of the 2019 Cost of Compliance Report.