REUTERS/Kacper Pempel (photo)

At Thomson Reuters we conducted two sets of interviews with the finance directors (FDs) at Top 100 United Kingdom (UK) law firms, ‘before’ and ‘after’ the impact of COVID-19. The interviews are part of our annual research amongst law firm FDs to look at what they see as the threats to their profitability and what they are doing to defend and grow the bottom line.

On some issues the views of FDs have been changed so substantially by the impact of COVID-19 that we will not be publishing the full results of those pre-COVID-19 interviews in full this year but we wanted to share the key findings in this article.

What we did find interesting when comparing the pre-COVID-19 interviews with the later interviews was that most of the key concerns of FDs—to use technology to manage costs, to reduce credit risks—have become only more important.

Before the storm

So, what were the priorities of FDs in Autumn 2019 when the first set of interviews were conducted?

At the time, the UK was suffering from severe Brexit-related nerves due to the delays in the withdrawal agreement, and resolution to the future relationship with the European Union (EU). Inbound acquisitions of UK companies had dropped by a fifth in number in 2019, according to the Office for National Statistics, and the broader UK economy was suffering from below trend economic growth.

Against this backdrop, a key priority for FDs was finding ways to reduce costs and maintain profitability. Of the FDs interviewed, 69 percent said they were likely to tighten credit control to achieve those goals and 69 percent also said they would cut unprofitable services.

In the interviews that took place, there was also a clear view that technology was going to a key feature of the year ahead and that those who fall behind in adopting it might struggle.

Falling behind on adopting artificial intelligence technology was the third most frequently cited risk to profitability, with 28 percent of FDs stating it is a high risk to profitability. Additionally, 50 percent also said they were likely to make more use of technology to improve profitability by cutting costs.

The importance of technology has also been underlined in the most dramatic of ways during lockdown with many law firms being put on a steep learning curve. The use of online collaborative working tools has now been embedded in the routine of almost every fee earner in the Top 100.

When the next leg of the lockdown is over, we anticipate that technology will be the focus of law firms in a way that it hasn’t been since the late 1990s when the internet, extranets, and email really burst on the scene.

After the storm

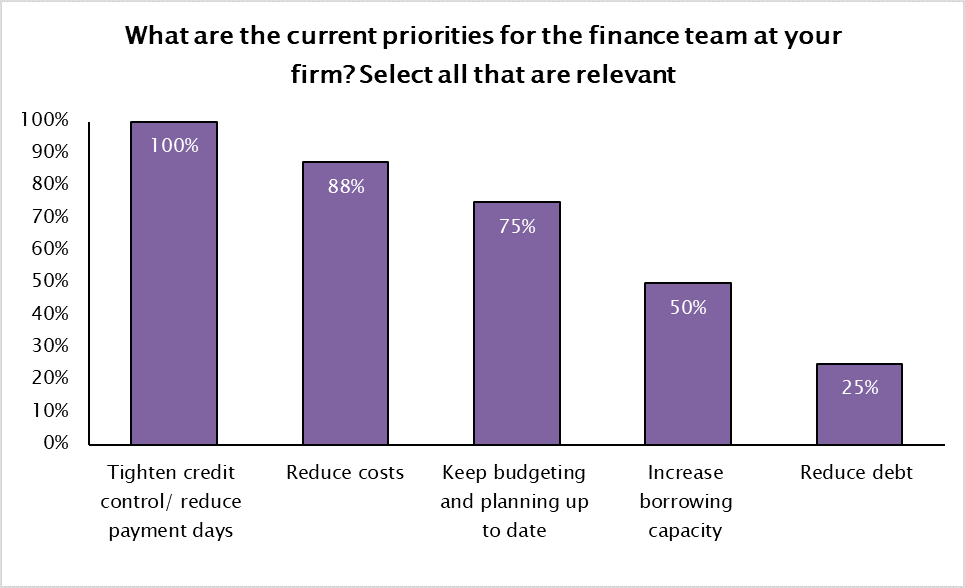

As we progress through Autumn 2020, there are still broad parallels with the priorities of FDs in Autumn 2019. As might be expected in an economy under pressure, 100 percent of the Top 100 law firm FDs in our summer 2020 survey identified tightening credit control and reducing payment days as a priority in the months ahead.

Moreover, 50 percent of the FDs said implementing new technology to improve profitability was still a major priority. Whilst 88 percent of FDs noted the same for improving risk management processes—particularly around data security.

From Summer 2020 survey

Although many strategic priorities remain the same, there has been a change in thinking amongst FDs as to what practice areas are most likely to grow in the new environment.

Key segments for growth

The growth segments identified by law firms before COVID-19 included GDPR related work with 56 percent surveyed saying they expect the area to show fast growth. The mega-fines by the Information Commissioner’s Office in the UK on a major airline and a major hotel chain have highlighted to boardrooms the potential cost of failing to comply with GDPR laws.

Fast forward to Autumn 2020 and restructuring & insolvency work is now expected to be the fastest-growing area of work picked by 88 percent of FDs surveyed. Insolvency related work is expected to pick up when a moratorium on some debt collection processes against businesses ends in 2021.

Commercial litigation is seen as the areas of work that will see the second fastest level of growth with 50 percent of FDs expecting this area to show fast growth. Litigation and dispute resolution increase after a recession as financial stress causes businesses to back out of contracts as they take radical action to try and keep losses down.

The second set of interviews, in the summer of 2020, also revealed what FDs think will be the positive outcomes of the current crisis. Of the respondents, 50 percent said that increased investment in technology would be a positive outcome and 88 percent think there will be a greater emphasis on flexible working.

Overall, it seems a large portion of FDs are maintaining a relatively positive longer-term outlook as to what effect long term impact the lockdown will have on their firms. Our interviews found that 50 percent of FDs are expecting their firms to be in as strong a position as now in six months’ time and 12 percent of FDs surveyed even expect them to be in a stronger position than now.

What came up time and again in the conversations with FDs in both 2019 and 2020 was, perhaps unsurprisingly, the opportunities posed by the continued development of technology and financial management. Credit management and reduced payment days to ensure that work gets converted to vital cash as soon as possible—and spending on technology as a fundamental operational step to help the fee earners keep that work coming in.

What is clear is that FDs, by their focus in 2019 on cost control, credit management and cash conversion put law firms in a remarkably good position to deal with the challenges of 2020—which has certainly been the most challenging period in the decade that we have been undertaking this research.

As we near the end of 2020, there still are two important questions to be answered. Before the end of December, there is the hurdle of achieving a final resolution to the UK’s relationship with the EU—will a deal be agreed upon or will it be a ‘hard-Brexit’? Additionally, the increased restrictive measures to get COVID-19 under control are currently still in effect—and we all hope for progress in reducing the spread of the virus before the holidays. Once there is progress made on these two significant issues for the UK, nerves should be considerably calmer as we enter 2021.

Looking ahead to 2021, our research for our next annual FD report is underway. If you are interested in participating in this research, please do contact us.

Samantha Steer, Director, Market Development, Large Law, Thomson Reuters

samantha.steer@thomsonreuters.com