Image credit: REUTERS/Dado Ruvic

Digital transformation is moving at a rapid pace. Policymakers, regulators, and firms all need to play their part in ensuring that cryptos are as ‘safe’ as possible not only in terms of investment risk but with regards to regulatory certainty and cyber resilience. In a new report and map, we look at the state of crypto-assets, their risk and regulation, and how their impact and acceptance is evolving around the world.

Crypto-assets have become the proverbial double-edged sword among financial experts. The rise and deployment of crypto-assets has pushed digital transformation and has the potential to make payments and transfers more efficient.

However, the speed and reach of such transactions — together with the potential for anonymous activity and for transactions without financial intermediaries — also make crypto-assets vulnerable to misuse and raise the risk of money laundering. Financial services firms, regulators and policymakers are all having to come to terms with the rise of a new class of product as well.

Download the full Special Report: Cryptos on the rise report from Thomson Reuters Regulatory Intelligence.

To look further at this evolving dynamic, the Thomson Reuters Institute and Thomson Reuters Regulatory Intelligence have created a new Special Report: Cryptos on the rise, which examines some of these developments as well as the risks and benefits of this next iteration of digital transformation.

The report also considers the problems arising from the lack of an internationally consistent definition of the term crypto, and the implications for financial services firms and their customers of a possible ‘arms race’ among central banks as they seek to deploy their own digital currencies.

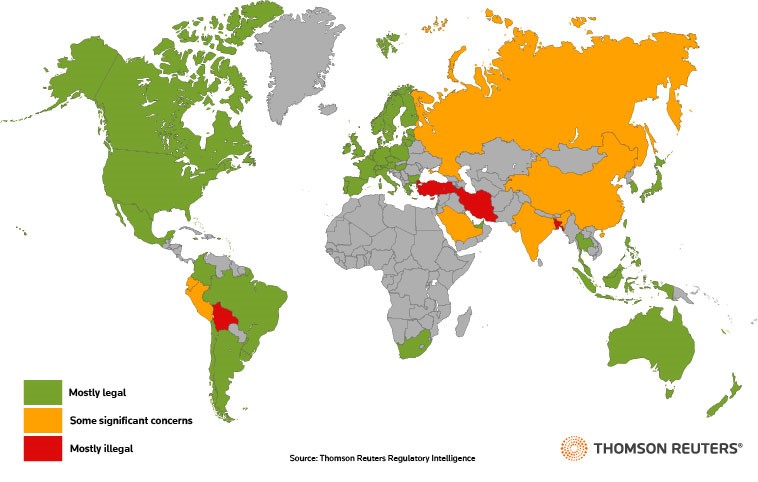

Access the new Compendium of Country-by-Country Crypto Regulations that shows the regulatory environment in countries around the world.

Further, the report notes the emergence of bitcoin as a mainstream financial instrument and assesses how that status has changed the risk profile in regard to money laundering and other misuse of cryptocurrencies for illicit or illegal activities. Indeed, cyber-risk is a concern for all cryptos, and the report looks at how firms, regulators, and exchanges can enhance their cyber-resilience.

The speed of technological change and a growing reliance on third-party, technology-based services is increasingly introducing new risks and vulnerabilities to the sector. — Randal K. Quarles, Vice Chair for Supervision and Chair of the Financial Stability Board, US Federal Reserve (March 2021)

In addition to the full report, a compendium that provides an overview of the regulatory landscape for cryptocurrencies and a global heat map (above) that displays the regulatory environment around the world are included and provide valuable information about the legality, tax treatment, and evolving regulatory framework on a country-by-country basis for more than 60 jurisdictions. A version of this compendium was first published by Thomson Reuters in October 2017.

Written by:

Susannah Hammond Senior Regulatory Intelligence Expert, Thomson Reuters

Todd Ehret Senior Regulatory Intelligence Expert, Thomson Reuters