Introduction

Brazil and Canada have developed and improved their economic relationship throughout the years, particularly in the last couple of years as they’ve strengthened ties and increased the flow of goods and services. The resulting relationship is a strong and dynamic partnership. Moreover, the numbers confirm their strong ties: in the last decade, trade between these countries increased more than 25%.

However, there are still many opportunities for Brazil and Canada to continue to nurture their relationship and grow, with a high demand for exports on both sides. In addition, both governments are interested in establishing a partnership by means of a Free Trade Agreement (FTA).

A special point in this series of articles is the Canadian government’s recognition of Brazil’s importance to their economy; similarly, the Brazilian government recognizes Canada’s role in their country. This is a strong partnership that goes beyond the boundaries of business transactions to areas such as the environment, services, science and technology, art and culture, and health—the latter funneling into their joint research for the eradication of the Zika Virus.

Now, it is up to Brazilian and Canadian businesspeople to further develop business and analyze customer needs to better supply increasing demands for their products while investing in each other in all sectors of the economy.

On the government side, negotiations started with an exciting scenario of increased global trade enabled by new FTAs.

Brazil Fact Sheet

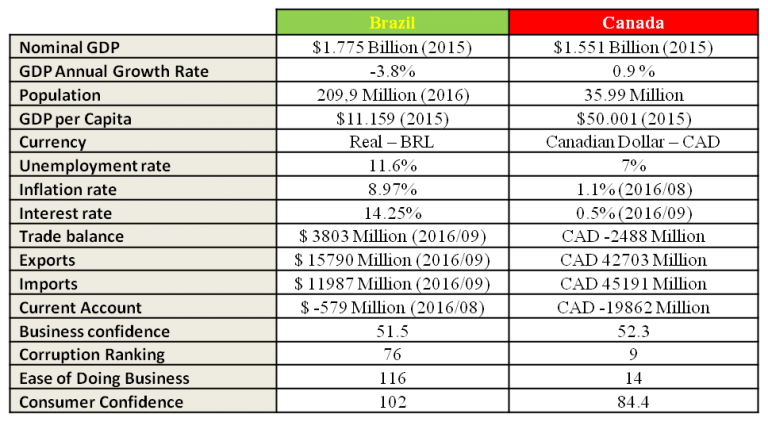

Brazil boasts the largest and most diverse South American economy. However, Brazil has faced adversity and crisis in its macroeconomic and political climate. Consequently, the inflation rate has been increasing; the economy in general has pointed a negative growth, also they’ve experienced the devaluation of its currency and a recent presidential impeachment.

Brazil has since executed strategies to revive economic growth, the results of which should materialize in 2017/18. One measure that stands out is the Export National Plan (Plano Nacional de Exportações – PNE), launched in 2015, with the goal to redress the gap between Brazil’s economic size and its export volume—in other words, promoting the export culture of Brazil.

The PNE is based on five key pillars:

- Market Access: This is the removal of trade barriers and greater integration into the network of trade agreements through bilateral, regional and multilateral actions on tariff and non-tariff matters

- Trade Promotion: Is the identification of 32 priority markets for Brazilian products

- Trade Facilitation: Supports the reduction of bureaucracy and simplification of administrative and customs procedures

- Export Financing: Implements the improvement of instruments to fund existing exports and provide support to entrepreneurs that have export financing needs

- Export Tax Regimes: Promotes the simplification of schemes offered to exporters, such as duty drawback and re-export programs

The most noteworthy aspects of the plan are the goals to more fully leverage Brazil’s position as a gateway to Latin America through inter-regional and intra-regional FTAs, and a host of new trade facilitation programs.

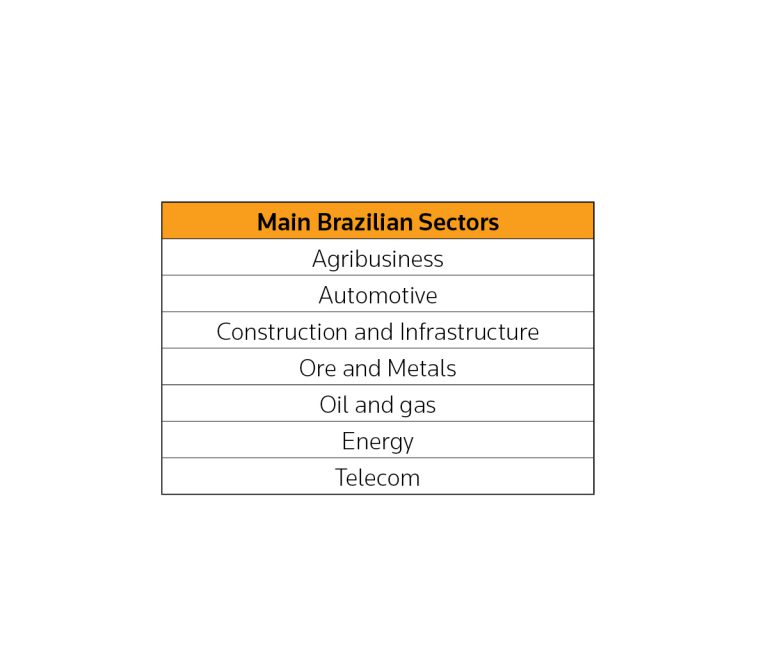

Brazil’s breadth of exports is varied and covers important sectors of the economy, positioning Brazil as the second largest exporting country in Latin America. Though, Brazil does not meet its potential as a gargantuan global exporter, with global trade representing only 20 percent of the Brazilian GDP. Although Brazil is among the world’s top 10 largest economies, Brazil ranks only 25th among the World Trade Organization’s largest exporters in the world.

Investment in Brazil

In regards to investments, Brazil provides a multitude of opportunities for international companies in numerous sectors; however, expensive tax regimes, bureaucracy and strong local and foreign competition continue to present challenges for exporters and investors around the world by moving into Brazil. To succeed in Brazil, companies must be prepared to establish a local presence, compromise in the long run, such as taxes payment that can be an unpredictable beast once it is a huge amount, however throughout the period it is worthy; also adapt to the demands of an extremely tight market.

Nevertheless, even if the country suffers an economic recession, Brazil has a large domestic market that includes over 200 million citizens.

Brazil – Economic Performance (MDIC Data)

In 2015, Brazil exported about US$191 billion, with a gradual decline of 14.1% in comparison with 2014. In addition, Brazil imported about US$171 billion, and dropped 24.3% over the same period, resulting in a positive trade balance—about US$19 billion.

In detail, Brazil’s main exports include: Soy ($20.9 billion); iron ore and concentrates ($14.0 billion); petroleum ($11.7 billion); frozen chicken ($6.2 billion); cane sugar, raw ($5.9 billion); aircraft ($4.0 billion). Moreover, Brazil’s primary imports include petroleum ($7.3 billion); medicines, both human and veterinary ($5.8 billion); parts for motor vehicles and tractors ($5.3 billion); passenger cars ($5 billion); fuel ($3.5 billion), and so on.

The top destinations of Brazilian exports are: China ($35.60 billion); United States ($24.07 billion); Argentina ($12.80 billion); The Netherlands ($10.04 billion); Germany ($5.17 billion); Japan ($4.8 billion); Canada ($2.36 billion). In addition, the main origins of Brazilian imports are: China ($30.7 billion); United States ($26.47 billion); Germany ($10.37 billion); Argentina ($10.28 billion); South Korea ($5.4 billion); and Canada ($2.4 billion).

Canada Fact Sheet

Canada is a developed and prosperous country with a stable economy. It’s also one of the most “economically open” countries in the Americas, with its economy based primarily on services, which represents the main portion of its GDP, followed by industry and agriculture.

Canadian industry is very diverse, with automotive, cellulose and paper, steel, machinery and equipment, high-tech products, mining, fossil fuel extraction, wood and agricultural industries to highlight a few of these industries. Those sectors’ growth continues to increase with the private and public sectors investing heavily in advanced technology development, mostly driven by advanced research centers and universities.

Canada has the 10th largest economy in the world (GDP – 2015); with a diverse portfolio of exports that emphasizes manufactured goods.

The main products exported are vehicles and auto parts, machinery and equipment, high-technology products, oil, natural gas, metals, and forest and agricultural products. Canada imports machinery and industrial equipment including communications and electronic equipment, vehicles and automotive parts, industrial raw materials (iron and steel, precious metals, chemicals, plastics, cotton, wool and other textiles) as well as manufacturing and food products.

Even if Canada is a country with a strong domestic market, promising consumers and export operations are the main share in the country’s trade flow. It primarily exports to the United States, which accounts for more than 70% of total exports—enabled by the two countries’ membership in NAFTA (North American Free Trade Agreement), a block that also includes Mexico.

Undoubtedly, FTAs have been increasing the competitive power of the country, allowing Canada to access a global market of US$20 trillion. Moreover, if ratified the TPP (Trans Pacific Partnership) as well as CETA (Canada EU FTA), Canada is slated to become the fourth country with greater access to other markets and greater than the countries of the BRICS together.

Canada – Economic Performance (StatCan Data)

In 2015, Canada exported US$424 billion and imported US$547 billion. The value of imports increased by 4.5% in 2015 and exports declined 0.8% over the same period since 2014. As a result, the annual trade balance of Canada with the world went from a surplus of $ 4.8 billion in 2014 to a deficit of $23.1 billion in 2015. In the same way, the nominal GDP increased from US$1,973 billion in 2014 to US $1,986 billion in 2015.

The U.S. is a notable, primary trading partner in that country. To illustrate, nominal imports from the U.S. increased 3.6% to $363.1 billion in 2015, despite the fact that exports to the U.S. decreased 0.8% to $396.5 billion, in comparison with 2014.

The value of imports from countries other than the United States increased 6.4% to US$184.7 billion. Imports from most major Canadian trading partners increased in 2015, led by China (+9.5%), Germany (+14.4%) and Japan (+18.7%). Meanwhile, exports to countries other than the United States decreased 0.9% to US$128.2 billion as a result of a huge reduction in exports to Italy (-45.0%). However, this is partially counterbalanced by increased exports to India (+ 33.0%) and Mexico (+15.8%).

Trade Relations Between Brazil and Canada

Brazil and Canada are extremely important to each other from a bilateral, regional and multilateral view. Diplomatically, both countries share values, mutual and democratic interests, as well as many similarities, such as support for inclusive growth to promote human rights and democracy, innovation in science and technology, and especially encouraging each other in bilateral trade and investment.

In fact, goods and investment trade flows experienced a significant growth, more than 25% in the last decade between countries.

Currently, Brazil is the 14th largest destination for Canadian exports, representing 0.429% of Canadian trade. In 2015 a volume of export to Brazil was $2.25 billion, an increase of 3.4% over the previous year. Likewise, Canadian imports from Brazil totaled $3.74 billion in 2015, an increase of 7.9% compared to 2014, positioning Brazil as the 14th largest partner of Canada’s economy as far as imports.

When considering investments, Brazil was the seventh most important country of origin of investments in Canada in 2015, with $19.7 billion with Brazil as the 12th largest recipient of Canadian direct investment at $12.3 billion in 2015.

Brazil and Canada – Trade Balance

As mentioned, trade between Brazil and Canada experienced huge growth over the last decade. Brazil is not only important for global trade in South America, but it’s also considered one of the largest players on the global stage. Because of Brazil’s position in South America, the Canadian government established Brazil as a priority focus for the actions of investment and incentives. By the same token, Brazil recognizes Canada as a major trading partner and has included Canada in all projects relevant to exports and investment incentives, as mentioned previously in the National Plan of Brazilian exports.

To illustrate, in 2015 Brazilian exports to Canada accounted for $2.362 billion, up to 2.03% in comparison with 2014, and imports account for $2.421 billion, down 10.50%, totaling $ 4,783 billion in trade flows, resulting in a trade balance of US +$58 million to Canada.

The list of top Brazilian exports to Canada includes oxide and aluminum hydroxides ($727 million); cane sugar, raw ($244 million); raw coffee beans ($139 million); crude oil ($99 million); and aircraft ($90 million). By aggregate factor, 2015 Brazilian exports were $434 million for basic products; $569 million for semi-manufactured products; $1.33 billion for manufactured products; $1.90 billion for industrial products and $19 million in special operations.

Regarding imports, the main products from Canada in 2015, include: Potassium chloride ($845 million); aircraft ($184 million); medicines for human and veterinary medicine ($146 million); coal, ($144 million); Newsprint in rolls or sheets ($92 million), and so on. By aggregate factor, Brazilian imports in 2015 included $203 million for basic products; $895 million for semi-manufactured products; $1.32 billion for manufactured goods and $2.21 billion for industrial products.

Brazil and Canada – Trade Balance 2016

Between January to August of 2016, Brazil exported $1,568 billion to Canada, up 8.58% over the same period in 2015, which was $1,444 billion. Imports were $1,219 billion, a sharp drop of 22% compared to the same period in 2015 that was $1,578 billion; resulting in a positive trade balance of US$349 million to Brazil.

The main products exported from Brazil to Canada from January–August 2016: Inorganic chemicals, etc. ($496 million); natural or cultured pearls, precious stones, etc. ($323 million); sugar ($149 million); boiler and machinery, mechanical appliances ($88 million); Iron and steel ($78 million); coffee, tea, mate and spices ($74 million). By aggregate factor, Brazilian exports this year (until August) presents $192 million for basic products; $545 million for semi-manufactured products; $819 million for manufactured products; $1,364 billion for industrial products and $10 million in special operations.

The main products imported to Brazil from Canada until August 2016 were: Fertilizers ($415 million); pharmaceuticals ($233 million); boiler and machinery, mechanical appliances ($160 million); minerals ($49 million); aircraft and other aerial devices and parts ($43 million). By aggregate factor, Brazilian imports through August of this year have generated $83 million for basic products; $434 million for semi-manufactured products; $700 million for manufactured products; and $1.135 billion for industrial products.

Bilateral Relations

The interest in tightening trade relations between Canada and Brazil have been discussed and dialogued over the past decade.

However, even though Brazil is the main supporter and mentor to negotiate a Free Trade Agreement with Canada, the article 16 of Mercosur Decision 32 does not allow Brazil to negotiate any bilateral free trade agreement independently. That means all negotiations must be conducted within the block with all member states present.

Mercosur

The evolution of trade between the countries of Mercosur in the last 25 years shows increasing numbers. For example, in a performance analysis of exports in this period, the amount within the block went from $4.5 billion in 1991 to $51 billion in 2015.

Such growth in volume within the block truly favors Brazil; for that reason it’s undeniable that Mercosur is of utmost importance for the Brazilian economy. One-fifth of Brazilian manufactured good exports are intended for Mercosur. As an example, Argentina is the largest buyer of cars produced in Brazil, with Uruguay as the third-largest oil importer from Brazil.

However, over the last 25 years of this partnership, Mercosur has not negotiated any agreement with the world’s largest markets, only Latin American countries. This has disadvantaged the Mercosur bloc especially as the global market continues to open up.

Since 1991, 25 years after the treaty was born, there were 253 FTAs on the globe; Mercosur was part of only two of them (Mercosur–India FTA and Mercosur–Israel FTA), which together represent only 1.69% of Brazilian exports (Jan to Aug/2016).

Recently, after some troubled months of local retraction, general announcements were made regarding the importance of the FTAs in the Mercosur arena, triggering a state of emergency. Brazilian negotiators in compliance with the National Export Plan has increasingly sought to exploit the extra-bloc countries, and one of the countries that is part of Brazil’s ambitions plan is Canada; one of the most open global economies.

Mercosur/Canada Free Trade Agreement

Mercosur and Canada held exploratory meetings in the past to assess the feasibility of opening formal FTA negotiations, after which resulted public consultations to better understand the Brazilian private sector needs. However, resistance (mainly from Argentina) prevented further serious consideration.

On 16 June 1988, Canada attempted to begin negotiations with Mercosur to develop regional and bilateral initiatives of an investment and trade cooperation agreement. Further plans did not progress.

Subsequently, a joint declaration was issued in 2004 when Canadian Prime Minister Paul Martin was visiting Brazil. He noted that the growing trade and investment flow would further bind Canada and Brazil—strengthening the possibility of a free trade agreement. The two countries agreed to promote the expansion of trade relations among Mercosur and Canada by negotiating greater market access in the areas of goods, services and investments; context of the creation of a future Free Trade Area of the Americas (FTAA).

Then in 2005, a joint statement announced discussions between the delegations of Mercosur and Canada. In September of the same year, a new meeting took place in order to evolve a FTA between the two parties, before severe government restrictions from Argentina stagnated the discussion.

Once again, in an attempt to start a new discussion about an agreement between Mercosur and Canada, a new dialogue began again in 2010. At the time, the bilateral trade between the parties had exceeded the amount of US$7.6 billion, making this possible partnership a strong potential trade expansion.

Discussions continued in 2012 with Argentina more open to the deal, being faced with the real possibility of a 55% increase in trade with Canada.

In summation, after beginning the discussion in 2010, only three meetings took place between Mercosur and Canada. Now the position of Mercosur is more favorable to the agreement since the previous event in 2012.

2016 and Beyond

The year 2016 is not over yet, and 2017 promises the possibility of great progress in a new era of FTAs.

This favorable position is influenced by various factors, including the new open Argentinian government, the Brazilian National Export Plan, the TPP being negotiated between major countries, and Europe creating trade barriers for a possible FTA with Mercosur.

Another important factor is that exports are complementary (not competitors), so negotiations should certainly be much simpler than the other negotiations that Brazil is currently facing, such as those with the European Union.

FTA Benefits

The benefits resulting from a FTA between Mercosur and Canada as it pertains to goods can be very significant. It is estimated that tariff reductions would benefit 30% of Canadian exports, which generates interest for various segments of industry, such as automotive, transportation equipment and some traditional sectors. That’s means, more than 2,000 items would benefit from tariff reduction.

The agro industry is projected to benefit the most, with the average taxation on Canadian imports being 17%. Upon proof of origin such products can access the market with reduced or eliminated tax rates, depending on the negotiations.

Brazilian companies will also reap the benefits since Brazilian imports would be exonerated. In this scenario, the pharmaceutical, chemical and aircraft industries would most benefit.

Such an FTA between Mercosur and Canada would surely go beyond the benefits of tariff reductions. In the current scenario of international negotiations, where the scopes of the FTAs are much more comprehensive, the gains would cover all sectors as well as all significant economic areas of both countries.

Compliance

In Brazil, where regulatory changes are made almost daily (with an average of three legal changes per working day), companies need to ensure compliance in their operations not only to track changes, but also to be agile in adapting its internal processes. It’s a great challenge, but it is possible to overcome.

The government increasingly invests in IT processes and systems for accurate monitoring of business operations. Companies need to manage their data effectively to mitigate the risk of inconsistent information, which may result in regulatory non-compliance and possible penalties. Information needs to be centralized and should be shared with all areas of the company.

Companies need to not only seek internal support to improve procedures, but also allow better visibility of information, prevent risks, support planning, as well as integrate and collaborate with strategic decisions.

In a recent survey conducted by Thomson Reuters in partnership with KPMG International, 59% of Brazilian participants emphasized the absence of specific systems for global trade management; 22% noted that the main factor for this situation is the lack of support or budget. This information lends itself to the conclusion that it is imperative for companies to prepare for and expand their global strategies, avoiding vulnerability to risks and possible fines presented by a lack in managing the global trade operations, FTAs in particular.

Conclusion

Economic crises can reach almost all sectors of the economy, but experts point out that if the company acts strategically, even in a vulnerable scenario, it is possible to identify opportunities for great business. However, it is necessary to expand your view by aiming to identify opportunities—as demonstrated with Canada and Brazil as they continue to discuss FTAs and the promise of significant economic growth.

Thomson Reuters offers market technology, human intelligence and relevant content combined with reliable solutions to support companies as they make such important decisions. The time is favorable for companies to rethink its current processes to become more competitive, participating ever more in the smart, fast and secure international market.

To learn more about ONESOURCE Global Trade and global trade trends, visit our website.

Sources:

- http://www.canadainternational.gc.ca/brazil-bresil/about_a-propos/overview-apercu.aspx?lang=por

- http://www.edc.ca/EN/Country-Info/Pages/Brazil.aspx

- www.mdic.gov.br

- http://www.statcan.gc.ca/daily-quotidien/160406/t001a-eng.htm

- http://www.statcan.gc.ca/daily-quotidien/160406/dq160406a-eng.htm

- http://pt.tradingeconomics.com/

- http://www.mdic.gov.br/comercio-exterior/estatisticas-de-comercio-exterior/comex-vis/frame-pais?pais=ind

- http://www.canadainternational.gc.ca/brazil-bresil/bilateral_relations_bilaterales/fs_brazil-bresil_fd.aspx?lang=eng

- http://www.mdic.gov.br/comercio-exterior/estatisticas-de-comercio-exterior/comex-vis/frame-pais?pais=ind